2 Background

2.1 Real-Time Technologies

The provision of information to travelers in real time depends on a variety of different technologies for data collection, aggregation, communication, and dissemination to the user. Many of these technologies are common across modes, although others are mode-specific. Table 2.1 lists some of the advantages and disadvantages of different sensor technologies.

2.1.1 Collection

To provide real-time traveler information, situational data concerning the travel conditions must be collected from the transportation network. Data collection requires sensors that can gather data, including infrastructure-based sensors or probe-based sensors. Infrastructure-based sensors are deployed as part of the modal infrastructure and monitor a specific point within the network. Probe-based sensors are deployed to vehicles operating within the infrastructure and track specific vehicle movements. Aggregated speed, location, volume, and weather information can be used to provide an indication of how vehicles are operating across a network. Although many of the collection methods can be used individually, gathering data from multiple methods often improves data collection efforts.

2.1.1.1 Infrastructure-Based Sensors

Infrastructure-based sensors are stationary data collection devices that monitor vehicles and weather conditions at a specific point of the transportation network. Often the most prevalent technology for many real-time data collection applications, they include in-pavement or non-intrusive detectors that measure vehicle presence, volume, and speed. In-pavement technologies are predominately inductive-loop detectors or magnetometers; non-intrusive detectors include passive/acoustic detectors, and, side-fire radar. Demonstrations were conducted in the Houston, Texas, area to determine the feasibility of using automated number plate recognition as an alternative to radio frequency identification (RFID)-based toll tag readers for determination of link travel times on urban arterials. Environmental Sensor Stations (ESS) are another type of sensor that collect road weather information for travelers.

Some transit agencies use signpost/odometer reading as a type of AVL technology that determines vehicle location by knowing the location of a fixed wayside signpost and the vehicle’s current odometer reading and scheduled route. The wayside equipment identifies the passing vehicle by a tag/transponder placed on the vehicle. Alternatively, loop detectors can be used instead of a tag reader. The wayside point relays information regarding the specific identification of a vehicle to a central point, while the vehicle relays information regarding the vehicle’s current odometer reading. This information is cross-referenced with the known location of the signpost, determining the vehicle’s location. Modern transit rail systems use wayside signaling for command and control operations and traveler information because they operate on dedicated right-of-way where schedule adherence is likely and often underground—where satellites cannot communicate with GPS transponders. However, while wayside systems were common in past decades for fixed-route buses, recent technology refreshes have provided for the proliferation of GPS-based AVL. Since these vehicles can communicate via a more accurate GPS-based system, the accuracy of vehicle location improves for vehicles traveling in dynamic traffic conditions.

Real-time parking data collection is also commonly supported by infrastructure-based sensors. Similar to collecting traffic information, smart parking must first gather data on the availability of parking spaces at targeted facilities. Such systems can employ a variety of detection methods including beam inductive loops, magnetometers, infrared or ultrasonic sensors, or video cameras and counting software. Determining the number of available parking spaces usually occurs by deploying sensors that typically either count the number of vehicles entering/exiting a given area (including entry and exit points or between areas within the structure) or detect the presence of a vehicle in a particular space. In choosing a real-time parking solution, implementers must make decisions regarding required data granularity based on the needs of the operator and customers. Space-by-space systems are able to provide highly granular and accurate information, maximizing facility efficiency, but require high installation and maintenance costs. Entry/exit facilities are less costly to install but are not as accurate, require manual resets, and buffer estimates.

Real-time parking information for commercial vehicles also uses the above methods, but due to the varying lengths of commercial vehicles, sensors require additional considerations. The Federal Motor Carrier Safety Administration (FMCSA) is currently working with vendors to demonstrate the ability to measure commercial vehicle parking availability with enough accuracy to warrant a pilot deployment.

CCTV cameras are another type of infrastructure-based method used to support incident detection/monitoring, system outages, and visual-based traveler information (such as through Web dissemination and media). While they do not typically provide quantitative data—although they may with the use of image-processing tools—they are widely used by the media and the public. Television stations will typically use a high-quality stream for broadcast, while Web sites will reduce image quality to save bandwidth. Analog video is being phased out in many locations for digital video, which can be compressed and shared more easily.

2.1.1.2 Probe-Based Sensors

In contrast to infrastructure-based sensors, probe-based sensors are mobile devices deployed to vehicles operating within the infrastructure. These sensors can be used to track the movement, location, speed, and volume of a specific vehicle (e.g., transit vehicles) or any vehicle across the network (e.g., passenger vehicles on a roadway) where a vehicle is tracked via a cellular, WiFi, satellite, or other wireless signal. With the growth in mobile computing and wireless communications, probe-based sensors are becoming more common. They are particularly conducive to transit information as transit agencies can more readily deploy and maintain systems on their fleet of vehicles. AVL devices using GPS are the most common form of probe-based sensors for transit vehicles. Although GPS AVL data serves fleet management purposes as well, it also forms the backbone for providing real-time transit information to customers.

Detection systems use GPS-based AVL to determine where transit vehicles are located, particularly in relation to their next scheduled stop. They use a group of geosynchronous orbiting satellites to bounce signals to a terrestrial transponder on a vehicle. Three or more satellite signals are used to estimate the vehicle’s location, speed, and heading, providing a highly accurate indication of the vehicle’s present location. One of the largest agencies in the United States, the Los Angeles County Metropolitan Transportation Authority has successfully deployed GPS-based AVL to its entire fleet to collect vehicle location information.

Probe-based methods for traffic data collection have seen increased interest as a means of expanding geographic scope beyond roadside sensor deployments. The private sector is collecting data from other private-sector partners such as commercial fleets (with GPS AVL) and cellular phone location data. GPS provides speed, location, and heading with a high degree of accuracy and has proven to be more accurate than methods that triangulate phone signals from cell towers. Triangulation methods also rely on business partnerships with the cellular carriers, for which traffic information is not a core focus. To date, despite rapid growth, firms have not been able to capture a sufficient market penetration of GPS-enabled phones to support probe-based traffic data, but the marketplace is rapidly evolving:

- Research firm Forward Concepts projects the compound annual growth rate for GPS chips used in cell phones at almost 40 percent through 2011.

- ABI Research predicts that by 2013, one in three phones sold will be a Smartphone, most if not all of which have GPS capability, an unlimited data plan, and the ability to run a wide variety of applications such as travel information.

Additional existing mediums are also being utilized for use as probes including Bluetooth tracking devices and RFID. RFID is most common with tolling systems, which are also being tapped to provide segment point-to-point travel time calculations.

2.1.2 Communications

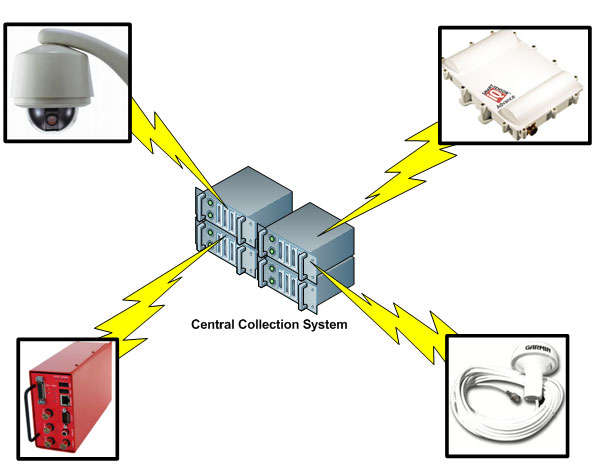

Real-time information systems require reliable communications as the backbone of their operation including the effective transmission of data from data collection devices and other ITS applications, such as data from individual loop detectors, GPS transponders, and CCTV images. After sensors collect data, information must be transmitted to a central collection system. To accomplish this task, systems require relay from sensors to a local process via radio transmission, fiber optic, or other communications medium. Data is aggregated to a central collection system. Wireless communications including cellular or radio transmission can be used, although they may incur substantial transmission costs. There are multiple systems using point-to-point and point-to-multipoint wireless backhaul that were installed extremely cost effectively. Dedicated systems provide high-quality real-time information, but are expensive and usually require communications infrastructure to be installed as part of the facility’s construction or as an add-on. To this end, some regions and states have established direct connections between DOT transportation reporting systems and law enforcement/public safety computer-aided dispatching (CAD) systems. Figure 2.1 shows a conceptual real-time communication diagram.

Figure 2.1: Conceptual Real-Time Communication Diagram

Many agencies are striving to develop more cost-effective methods for communications infrastructure. Communications technologies like T1 lines require sizeable monthly fees, while using Web and Extensible Markup Language (XML) technologies over wireless communication links promises to be less costly because these systems require minimal infrastructure. For example, providing real-time transit information for all of the Chicago Transit Authority’s (CTA’s) approximately 2,000 buses would require a wireless communications infrastructure capable of handling the entire network, especially since location updates need to be received frequently. CTA is exploring using cellular networks or WiMAX to provide continuous cost-effective communications updates. In addition to wireless communication in real time, AVL data can be stored onboard for nightly retrieval to evaluate schedule performance.

2.1.3 Aggregation

Once data pertaining to situational awareness is collected and communicated to a central server, it must be aggregated and analyzed to develop useable information. Algorithms are used to predict estimated travel time for in-traffic or next-vehicle arrival time at downstream transit stations and stops. To maximize the accuracy of information outputs, it is often best to collect and aggregate many types of data from various sources to ascertain real-time traffic conditions and performance measures.

2.1.4 Dissemination

2.1.4.1 Location for Information Dissemination

Methods of dissemination for real-time traveler information adhere to three specific intervals when and where customers seek real-time information, including pre-trip, in-terminal, and in-vehicle information. While pre-trip and in-vehicle information is relevant to all modes, in-terminal information is only related to transit and freight information. Travelers require different types of information at various periods of their journey, as described in Table 2.2.

2.1.4.2 511 Systems

All of the transportation modes can use 511 to disseminate information to customers. 511 is a publicly available service that allows users to retrieve relevant transportation information over the phone. 511 systems use Interactive Voice Recognition (IVR) systems to allow callers to access both static and real-time information by dialing 511, voicing or keying in their specific mode and/or route choices, and listening to information. State DOTs, regional transportation agencies, and transit agencies continue to plan for and invest in both phone-based and Web-based 511 services (available to 70 percent of the population in 2009). 511 systems have the added benefit of being accessible to customers at any point in their journey including pre-trip, in-terminal, and in-vehicle.

Similarly to passenger vehicles, commercial vehicles can receive real-time traveler information, including truck-specific information, from the public sector in a variety of ways including 511 systems. 511 systems, while convenient and practical given the large number of drivers that own cell phones, have recently been discouraged for trucks by the National Transportation Safety Board (NTSB) because they create a safety issue by introducing a distraction for drivers. Restrictions on cell phone use for drivers of passenger vehicles is also restricted to hands-free use in some states including California, Connecticut, New Jersey, New York, Oregon, Washington State, and Washington, DC.

2.1.4.3 Dynamic Message Signs

DMS are light-emitting diode (LED) or liquid crystal display (LCD) in-terminal or roadside signs displaying traveler information that can be updated in real time. A DMS is usually effective anywhere in the vicinity of travelers. DMS can be particularly useful for providing location-specific parking information, next-vehicle arrival times at transit stops, and wide-area alerts during emergency situations. The public sector has seen an increased reliance on DMS for incident/closure information and real-time conditions (existing in 43 metropolitan areas and planned for 15 more).

2.1.4.4 Online Applications

Online applications provide a medium through which travelers can access a variety of static and real-time information regarding vehicle arrival and preferred routing. Online applications can also be used to disseminate alerts, congestion, weather, parking, and schedules via data feeds using email, Websites, Really Simple Syndication (RSS) feeds, and Twitter. Emails can be used to disseminate information to customers who sign up to receive automatic updates, allowing them to receive information specific to routes or geographic areas for which they are interested. RSS feeds are XML messages that allow users to access information such as news headlines and blogs, but are also able to display travel information. Twitter, a social networking application, is a text-based microblog that can display updates including service delays or outages. One Website, my511.org, allows users to set up a personalized 511 service for faster, easier access to information regarding recurring trips.

Many agencies and operators are focusing their efforts on developing add-ons for applications and devices already owned by travelers, allowing them to skirt additional infrastructure costs. Many external developers are also focused on providing applications including Google and Apple, through Google Maps and iPhone applications, respectively. However, the information that agencies are able to provide via social networking applications may be limited by state/local laws or the agency’s charter.

Parking information Websites were cited as the primary method for pre-trip information dissemination. When providing pre-trip information, service providers should be cognizant of how they provide information to customers. In addition to providing reliable predicative information, it may be necessary to contextualize the number of spaces available via a color scheme (e.g., green means ample parking, red means no parking) so that customers can make informed decisions. Websites can collect information from a variety of public and private sources as well as allow social networking functions where users can discuss their experiences with specific parking locations.

Wireless applications, such as those in Smartphones and personal navigation devices (PNDs), also provide real-time traveler information at any point in a customer’s journey. Smartphone applications allow users to wirelessly access information from their everyday handheld devices, including many of the online applications discussed in the previous section. Such applications are an increasing focus for many operators and agencies because of the ease of pushing information into the public domain and into the hands of users. In addition to providing drivers with parking information, Smartphone applications that provide two-way communication allow customers to reserve a parking space in anticipation of their journey. As opposed to Smartphones which access online content, PNDs receive device-specific content via satellite. This can be used to provide turn-by-turn navigation as well as to disseminate real-time traffic information including congestion and incident alerts. PNDs could also be used to disseminate parking or transit information to travelers, but so far only a few examples have been deployed.

2.1.4.5 Highway Advisory Radio

An HAR disseminates traveler information by AM or FM radio. It is frequently used to disseminate information in specific locations via low-power radio stations. It has been used to provide parking information at some large airports, although few examples have been deployed. Similar to passenger vehicles, commercial vehicles can receive real-time traveler information via HAR. Additionally, truckers can utilize CB Wizard, a Citizen’s Band (CB) radio system that broadcasts real-time direct message information to commercial vehicles. It has been met with mixed opinions in the industry. While many truckers appreciate the information provided to them, others would prefer to keep the channels open for peer-to-peer communication.

2.1.4.6 In-Vehicle Telematics

In-vehicle telematics is a fast-growing industry. As with most in-vehicle technologies, these were first seen in luxury cars, but they are quickly becoming more commonplace in all makes and models of personal vehicles. Both in-vehicle and aftermarket personal navigation systems are now very common and affordable. Examples of in-vehicle telematics systems are GM’s On-Star and Ford’s SYNC. On-Star has been providing two-way communications services for a few years now, including notification of when the airbag has deployed or human interactive directions. Ford SYNC connects with other portable devices and provides directions and traffic information.

Aftermarket PNDs, such as those from Garmin, TomTom, and Magellin, offer directions and real-time traffic services on some models. These additional services often come with a fee. They are also typically communicate one-way over FM radio frequency sub-bands.

To date, the commercial vehicle industry has the most successful deployment of in-vehicle telematics, including onboard communication systems linked to an information service provider. Systems are available factory-installed by the manufacturers on some newer vehicle models or as an aftermarket add-on. Devices provide two-way communication between drivers and dispatchers/service providers via satellite or cellular communications.

Systems are capable of tracking a vehicle for the entire length of its journey using GPS transponders on the vehicle, allowing a trucking company or third-party provider to monitor route, operational performance, and external conditions. This data can be communicated back to the driver and the vehicle to improve performance and provide information to other vehicles in the vicinity. The service provider also can forward routing, traffic, and weather information to the driver. Such systems are particularly useful for long-haul drivers, who often operate in areas they may not be familiar with and are isolated from their dispatchers and maintenance crews for longer periods of time. While many technologies are available to commercial vehicles, some difficulty exists in convincing computer-resistant truckers to adopt newer technologies. Several specific onboard communications systems include:

-

Volvo Link Sentry is an onboard system provided by Volvo on all of its new vehicles, allowing for communication directly to the driver via instruments on the dashboard. The equipment monitors systems on the truck, returning the data to Volvo, who can monitor and adjust onboard systems in real time, diagnose problems, help maintain emissions regulations and fuel optimization, or even effect a vehicle shut down when necessary. Such systems are attractive to smaller trucking companies because they allow them to level the playing field by receiving information that, until recently, was only available to the large companies via dedicated company dispatchers.

-

Qualcomm provides after-market in-cab systems, which can provide drivers with information related to load assignments, route suggestions, and fuel optimization. Many systems also track hours logged per day and per week. Qualcomm’s system can track each vehicle by satellite to provide relevant information alerts to drivers via a text message display within the cab including routing, load assignment, and traffic information as well as other updates such as AMBER and terrorism alerts. For safety reasons, only the first 16 characters are displayed in motion, providing enough information for the driver to determine whether it is necessary to pull over to read the entire message. The system also features a “weather button,” which provides the driver with real-time radio updates regarding current and forecasted weather, procured directly from the National Oceanic and Atmospheric Administration (NOAA).

- Maptuit provides in-cab information to commercial vehicles regarding traffic and routing, providing trucks with the safest, fastest route available. Routing information updates are collected from and redistributed to all participants in real time, with trucking companies sharing the benefits of knowing where each truck is located. However, because all individual origin/destination (OD) information is kept internally and only sanitized information is disseminated to trucks, companies are able to protect their proprietary location data.

2.2 Emerging Technologies and Applications

The technologies that support real-time information collection, communication, aggregation, and dissemination are evolving. For example, improved sensor technology is creating new opportunities and business models. More robust deployments are providing the opportunity to collect more accurate data. Increases in the proliferation of wireless communications and in-vehicle telematics are providing new opportunities for connectivity.

2.2.1 Increased Probe-Based Programs

To promote the deployment of real-time traffic information systems, the use of probe-based data collection programs is increasing to provide more robust coverage of geographic areas with limited sensor coverage. In May 2008, a series of awards were made to areas for field operational tests (FOTs) to develop and demonstrate applications that meet the SafeTrip-21 goals and objectives, including:

California Connected Traveler FOT in the San Francisco Bay Area – The test uses GPS data from GPS-equipped personal mobile/wireless devices to develop applications to enhance the reliability of data. The “Mobile Millennium” ITS application was developed in California to use location data from up to 10,000 GPS-equipped mobile phones voluntarily collected to develop improved travel-time predictions for both highways and arterials. The “Network Traveler” application supports audible alerts on GPS-enabled cell phones regarding upcoming hazardous conditions, supports transit travelers with en-route transit trip information, and supports more customizable information to travelers.

I-95 Corridor FOT between North Carolina and New Jersey – The test is developing an “Intercity Trip Planner” that uses vehicle probe data, trip planning software, and map display software to provide a graphical display of real-time roadway conditions/speed via a Website. The test may serve as a model for providing more complete multimodal trip planning.

Private-Sector Probe-Based Programs – Firms such as INRIX, NAVTEQ, TrafficCast, and others are leveraging commercial fleet GPS and other sources of traffic data for information services. These vehicles are far more likely to have GPS and transmit their location in real-time for fleet management purposes. Private-sector probe-based systems leverage supply-chain partnerships to deliver probe-based traffic data. Furthermore, these private-sector traffic information providers are now integrating data with more traditional navigation systems to further extend their probe-based networks.

2.2.2 Improvements to Transit AVL

Transit vendors are creating more efficient AVL communications systems that provide for more frequent updates and are integrated with additional technologies for improved accuracy and/or reliability. For example, newer systems often supplement GPS-based AVL with a dead reckoning capability, which combines the vehicle’s odometer output with GPS to increase accuracy. However, transit agencies with newer systems may have to reconcile GPS and AVL systems from different vendors and technology eras to achieve uniform functionality. For example, the systems may also provide data at different frequencies (e.g., anywhere from 1 to 5 minutes), different levels of accuracy (e.g., 0.5 to 250 feet), or from different algorithms that provide the estimated time of arrival differently (e.g., is the arrival time estimated for a bus stop, or is it calculated as a schedule deviation from last time point).

2.2.3 More Accurate Parking Sensors

Unlike many other market segments, real-time parking information is a relatively newer field. Vendors providing sensors are developing more accurate and affordable infrastructure-based sensor technologies to create more sustainable business models. Sensors are rapidly becoming cheaper, smaller, and more ubiquitous, allowing more systems to use the more granular vehicle presence detection method and increasing overall accuracy. In particular, vendors are close to developing sensors appropriate for usage in commercial vehicle parking facilities, allowing expansion into this additional market where the variable sizes of commercial vehicles have previously limited deployment.

2.2.4 Proliferation of Wireless Devices

The proliferation of new wireless technologies is allowing more customers to connect to real-time information on a regular basis. The penetration of cell phone usage has exploded in recent years to the extent that there are now a number of households without landlines and a number of young people who are only familiar with cell phones. 3G wireless networks have facilitated faster and large data transfers using cellular technology, allowing Smartphones to quickly access real-time information. With the recent rollout of 4G networks in several select cities, wireless communications will become even faster. Figure 2.2 shows the estimated increase in wireless devices, both in-vehicle and handheld devices.

Figure 2.2: Estimated Increase in Wireless Devices

2.2.5 In-Vehicle Telematics

In-vehicle telematics that provide two-way connection devices will become increasingly common. This will enable drivers to receive more information and entertainment in their vehicles, including the integration of navigation systems that display real-time information. In-vehicle telematics could be the next frontier for bringing an on-screen interaction into the average American’s life, just as they use televisions, computers, and cell phones. Such an extensive market penetration would require close coordination with each of the major automobile manufacturers, who currently maintain individual in-vehicle software applications that might be difficult to integrate into a common system. Ideally, such systems could one day provide a variety of real-time information, including more robust incident, congestion, weather, transit services, parking space location and reservation, and gas prices.

New devices like in-vehicle telematics and Smartphones can serve a dual purpose. In addition to providing the customer with real-time information, the GPS-equipped transponders and other sensors can also be used as probes to collect information. Limitations include the funding and development of applications to support the collection of data other than speed and flow. The technologies have been developed to allow for additional data collection, but a higher level of demand is required to implement this capability. This additional data includes information such as road condition, pavement condition, and other types of information, which will enable more active traffic traveler information (including safety warnings and alerts). Both the public and the private sectors see Smartphones as an opportunity to collect quality data based on their growing market penetration. Early deployments of data collection are working through certain privacy challenges and concerns and will establish some base standards for expansion of data collection through these devices.

While the commercial vehicle industry has already deployed the most complete in-vehicle telematics applications of any of the market segments, the proliferation of onboard communications devices will increase in the industry, particularly in private-sector applications provided by original equipment manufacturers (OEMs) or after-market vendors. Initially, only large operators were able to fund the substantial capital costs associated with obtaining telematics. While many small carriers still balk at procurement costs, the addition of new vendors to the market has forced costs down. Trucking companies will continue to install GPS transponders and in-vehicle telematics in their vehicles to the extent that most companies, even small carriers, can experience benefits. Even short-haul trucking companies (e.g., drayage, dump trucks, and garbage trucks) are retiring their radio-based communications systems for public carrier push-to-talk services and in-vehicle telematics that include integrated AVL and data applications.

2.2.6 IntelliDriveSM and Commercial Vehicle Infrastructure Integration

IntelliDriveSM represents an opportunity for real-time data to be collected and used by onboard vehicle systems. This capability could potentially serve as a means of gathering and distributing vehicle data in support of applications and products designed to diagnose and predict road weather conditions and share that information with agencies for disseminating traveler information. The automotive industry is making significant technological advancements in the areas of vehicle environmental sensing and vehicle responsiveness to road conditions. Because of these developments, direct measurements of environmental factors such as pavement temperature and barometric pressure could provide a robust real-time data set; vehicular activities such as wiper setting, activation of anti-lock brakes, and stability control could also support onboard safety applications as well as transmit this data to operations centers. It is also expected that continued innovation within the automotive sector will provide opportunities to measure additional atmospheric and road condition parameters. IntelliDriveSM also seeks to enable multi-modal application, providing users with an in-vehicle application that combines traffic, weather, transit, and parking information in a single application.

The New York State DOT’s Commercial Vehicle Infrastructure Integration (CVII) program is working to develop commercial-vehicle-specific applications including real-time truck travel information. However, unlike passenger vehicles, a large number of commercial vehicles already have in-cab systems, and there is less need for static fixed-roadside readers. CVII will be successful if it can develop methods to retool the commercial vehicle industry’s existing IT infrastructure. The proliferation of commercial vehicle telematics systems and CVII could increase the ability of both the public and private sectors to use the 2.7 million trucks on the road as data probes to provide more detailed information regarding traffic conditions and freight movements.

2.2.7 Proliferation of Social Networking

Social networking is increasingly becoming an additional tool for state and local transportation agencies to disseminate real-time traveler information. Customers can access Websites via their computer or wireless to receive traffic updates, work zones information, and emergency notices. Information is often in the form of short text messages, although longer audio messages are also possible via some online media. Additional information regarding social networking and the issues surrounding its use can be found in the Usage Section of this document.

2.3 Procurement Approaches

Real-time traveler information is rarely the work of one entity to deliver. There are many potential roles for many partners, from both the public and private sectors, to provide the necessary technology applications, data collection strategies, information aggregation, and fusing of real-time (and potentially non-real-time) data to use for traveler information and other purposes, as well as ultimately disseminating that information in a format that is usable by travelers and other entities.

There are a number of gaps that could require both the public sector and the private sector to seek out partnerships to fulfill traveler information program needs. For example, traffic data collection has historically been a responsibility that resided with the public sector; DOTs deploy detection on urban area freeways to provide real-time traffic volume and speed data that could be used to support traffic management as well as traveler information needs. Similarly, transit vehicle location and performance data has largely been the responsibility of transit operating agencies, sometimes supported by a system vendor for the AVL data systems. Parking information, on the other hand, includes significant involvement from both the public and private sectors in that facilities can be either municipal-owned or privately owned. Real-time data for parking was often focused more on revenue-collection systems, but there is increased recognition that information about parking facility and space availability is a growing area of interest, particularly in congested urban areas.

With partnerships and formal contract arrangements come a range of questions and issues that must be addressed for the partnership to be successful, including data and system ownership; privacy; intellectual property rights (particularly for private sector systems); data quality standards; data sharing; and in recent years, the commercial value of data.

This section discusses different procurement and partnership approaches to support the continued expansion and enhancement of real-time traveler information systems, as well as presents some case study examples of successful partnering and contracting approaches.

Partnerships and procurement approaches between public- and private-sector entities can take several forms:

-

In-House Data Procurement – The public sector can do it all, and has limited involvement with the private sector to support its traveler information activities.

-

Partnership with Private Entity – The private sector provides a contracted service or commodity for a fee to the public sector; this could be to supplement what the public sector is already doing or to address a gap in public-sector coverage, capabilities, or technical resources. In addition, the private sector could be an “in kind” partner, who obtains access to data that is generated by the public sector (often at no charge to the private sector), and then uses that data to support the private business model and activities.

-

Buy Data – The private sector provides a substantial operations or other role, for a fee, and is an essential partner in the development or delivery of a traveler information function or service.

2.3.1 In-House Data Procurement

This model represents a substantial investment by the public sector in the data collection and dissemination arenas, but one that provides the agency with the most control over its data and its dissemination. Traditional models for traffic-focused traveler information have seen a substantial role for the public sector (typically, the state DOT) to deploy equipment, collect real-time data, consolidate or aggregate that data, and provide it to users through their publicly owned infrastructure (including DMS, HAR, agency-operated Web sites, 511 phone systems, and other dissemination means). This does not necessarily mean that the private sector is not involved; in fact, equipment and systems are typically procured from the private sector (particularly for detection). However, the agency would retain primary responsibility for data management and data usage to support traveler information and other operational functions.

Transit also has historically seen a large role for the public sector transit operations agency for data collection and dissemination, although vendors may play a role through contracting arrangements. For example, the CTA operates its own prediction software based on AVL, and is enhancing its prediction software using historical information derived from stop adherence and remotely installed devices. This could be a function of the AVL vendors, but the CTA’s decision to keep this activity in-house provides them with increased freedom over information outputs including how it is provided to transit riders. Denver Regional Transportation District (RTD) is also in the process of developing in-house algorithms after too many difficulties trying to rectify internal data sources with external software packages. While large transit agencies such as the CTA and Denver RTD have the technical ability and resources to develop in-house applications, many smaller transit agencies lack the scale and technical expertise to make the development of these systems cost effective.

For parking, it is advantageous for municipal governments to maintain control over data about their facility operations. Municipal governments are the primary customer of parking information and take primary responsibility in funding for parking information to the public. They need to be aware of how parking affects long-range planning, pricing, performance measurement, and workforce management. Parking information can be used for policy planning, systems optimization, and how pricing or temporal effect will affect the use of the new parking systems. Information can be shared with operators, municipalities, transit authorities, and urban planners. This data might not be as readily accessible to public-sector entities if they did not have a significant share of control in the data.

2.3.2 Partnership with Private Entity

Private vendors are often focused on developing innovative technologies that can be turned into cost-effective marketable products, particularly when there is a niche that is not already being met by other vendors. Vendors strive to increase implementation of their products and technologies, investing in market development when necessary.

AVL is a key example of an area where transit agencies can choose to deploy and manage such systems, but most opt to contract with private vendors with the expertise to install AVL systems and supply data outputs for agency use. The private sector is enthusiastic to provide AVL data for transit agencies and develop innovative products when evidence suggests a market niche, providing a trend of continuous deployment and implementation. However, the public sector, not end users, is the private sector’s primary customer. This differs from some of the traffic models where the private sector often has market potential with the public sector; other private partners; and in some instances, the end user directly.

The Intelligent Transportation Infrastructure Program (ITIP) was the first large-scale effort to outsource the collection of traffic flow information to the private sector. ITIP was originally designed to provide traffic data to public agencies for operations and planning, while enabling the private entity to earn a sustaining profit through commercial use of the data collected. There was no charge to the agency for the data, and in exchange, the agency would provide right-of-way for the data collection sensors. Of those 40 metropolitan areas, 25 have deployed or are deploying sensors under this program. The program did not receive full support by many of the states invited to become partners, due largely to the restrictions placed on what the agency could do with the data, even though the agency was receiving the data at no charge. Most significantly, many agencies were not allowed to use the data for traveler information, either on Web sites or on DMS, in order to protect the commercial value of the data and allow Traffic.com to be able to generate revenue through its other partners. (Transportation Technology Innovation and Demonstration Program)

Parking is another area where public and private partnerships are necessary to lead to the most effective regionally integrated parking systems. Public agencies and private garage operators look to private sector experts to provide the most advanced technology, requirements, and specifications for implementing parking information solutions. Once systems are deployed, information sharing among public and private entities is a necessary component of smart parking to aggregate information regarding availability and pricing across multiple facilities within a geographic area to maximize the benefit to customers. It is important to note that the public and private sectors may have conflicting interests in the deployment of parking information systems; for example, the public sector is concerned with maximizing utility, while the private sector aims to maximize utilization and revenue. However, both sectors have a common interest in improving parking facility efficiency.

2.3.3 Buy Data

In recent years, the private sector has emerged as a viable source of real-time traffic data, a role traditionally kept within the public sector realm. The emergence of probe-based approaches and applications allows for more ubiquitous coverage on the roadway network for speeds and travel times (important for traveler information), but does not provide the granularity of data that is typical of a sensor-based deployment. Although this is an emerging model for traffic information, probes are not yet considered a viable data source for transit or parking.

Public agencies are now viewed as an important customer base for private companies focused on real-time traffic data collection. First, through cell phone tracking technologies and, more recently, through contracting with fleets for GPS data, private firms are selling their traffic data to both public agencies and private companies. Notable procurements include the following:

-

The Wisconsin Department of Transportation (WisDOT) contracted with INRIX to provide real-time traffic flow data for nearly 250 miles of US 41 and I-43 between Milwaukee and Green Bay.

-

Cellint has been delivering cellular-based traffic information to the Georgia Department of Transportation (GDOT) since 2006 on Georgia 400 and nearby arterials.

INRIX is providing data on 1,500 miles of freeway to the I-95 Corridor Coalition, the public sector’s largest-ever traffic data procurement. -

NAVTEQ has been selected to provide statewide traffic data to the state of Michigan. While not yet under contract, this will be the second-largest public-sector probe data procurement to date.

This procurement option provides agencies with data on urban and non-urban area corridors that are not instrumented through typical public-sector detection approaches, due to the lack of resources to deploy, operate, and maintain detection equipment on the part of the agency, or as a supplement to existing systems. Although this is an emerging model, the procurements identified above will provide valuable lessons learned in the public-private partnering for real-time probe data to support traveler information as well as other agency operations functions that rely on real-time network data.

Privately supported data collection, aggregation, and information dissemination strategies can have a significant impact for freight. Vendors like Qualcomm and Maptuit are already providing real-time traveler information to the commercial vehicle industry and have developed sustainable business models providing a suite of location, traffic, routing, weather, and vehicle performance information. Truckers value such information because it can increase efficiency, including saving time and decreasing fuel consumption. Trucking companies, especially small carriers, value having a third-party provider aggregate and manage such information. Although some states have begun to implement freight-related data as part of their traveler information systems, it is often not comprehensive enough to meet the information needs of commercial drivers.

2.4 Procurement Trends

As travelers and the providers of data grow accustomed to having real-time traveler information based on probe data, business models will emerge to be able to incorporate IntelliDriveSM and safety applications across all modes—traffic, transit, parking, and freight. Vertical integration is envisioned to be a sustainable business market to continue to position the private sector for maximizing their potential and for public agencies to leverage the innovations of the private sector.

Three very recent public-sector procurements for private-sector data for traffic information mentioned in the previous subsection (WisDOT, I-95 Corridor Coalition, and Michigan DOT statewide data) point to the trend of agencies seeking alternate sources of network conditions data on corridor and statewide levels. Recognizing that there are cost and resource limitations to public-sector funded infrastructure-based solutions for detection, these procurements (and the resulting evaluations) indicate that although agencies see value in having real-time corridor information beyond urban area freeways, there is an opportunity to explore alternative means of obtaining this information on a larger scale, and procuring from a private entity could potentially address this need.

It is important to include the private sector in the process of providing real-time traveler information. The private sector has had difficulty in developing sustainable business models involving a direct real-time information transaction with the end user. The industry has discovered that travelers are only willing to purchase real-time traveler information when it is part of bundled services, such as an add-on to a navigation system; stand-alone information has not been marketable. To continue to ensure private-sector participation, the public sector needs to be willing to support open and standard data formats that begin to converge on de-facto transit standards. While open source data can provide opportunities for independent developers, it can threaten the existing business models of traditional private-sector vendors who rely on the data as their proprietary information.

Although it is still a developing industry, several potential business models have been developed for smart parking applications for both the private and public sectors including models based on payment from end users and municipalities. Most parking vendors have developed both purchasing and leasing models for their products, charging parking facility operators a flat fee for implementation and operations and maintenance (O&M) of their products. However, a profit-sharing model is also possible, where a vendor would provide free installation in exchange for a percentage of the facility’s revenue. Another potential model exists for a private company to collect and license information to users for other applications including municipalities, aggregation Websites, handheld GPS navigators, or wireless applications.

2.4.1 Subscription and End-User Charging Models

There remain some unknowns in travelers’ willingness to pay for real-time information. The subscription model has been a common approach in the traffic arena for several years, although those models that were based solely on end-user subscription fees have not proved to be sustaining. The most successful approaches have leveraged different potential sources of revenue, and have not been dependent on one specific revenue source. From a private-sector perspective, there is continued growth in supply-chain partnerships among multiple private providers to deliver traffic data, and an increased trend toward integrating data with more traditional navigation systems. As firms with a national footprint for data collection (including NAVTEQ, INRIX, and TrafficCast) partner with application developers and distributors, there is a continued trend toward enhanced offerings (bundled services) through subscription-based services.

Automobile OEMs have strategically partnered with providers of traveler information, navigation, and telematics services as technology and innovation have been greatly enhanced in the last decade. INRIX has collaborated extensively with Ford to enable personalized driving content and technology for Ford SYNC with traffic, directions, and information. XM and Toyota have extended their partnership through 2017 to provide XM NavTraffic in their vehicles. Lexus also partners with XM to provide the navigation package in its vehicles. ATX is a provider of customized telematics services to automobile manufacturers including Toyota, BMW, Lexus, Mercedes, and Rolls-Royce. Some OEMs such as GM have offered OnStar, an in-vehicle warning/safety system, at no additional cost in the sale of the vehicle. These services include location-specific emergency and roadside assistance, automatic collision notification, remote diagnostics, and real-time traffic and navigation assistance. The cost of the electronics equipment is dropping as technologies and competition develop and production volume increases.

Transit agencies have not been able to develop a way to make money on real-time information, instead viewing it as an add-on to transit services. Even when providing travelers with real-time information, agencies have been reluctant to charge the customer for more than the normal fare. However, sustainable business models have been developed by the private sector with the public sector as its main customer, including private sponsorship of transit data as part of a public-private arrangement for providing real-time transit information.

End users can be charged directly for smart parking by either public or private operators, via either a surcharge at a facility or as part of an online reservation. Parking reservations have proven a powerful value-added service for which many customers are willing to pay a surcharge, especially when it is bundled as part of a transaction (e.g., adding reserved parking at the stadium when purchasing baseball tickets). The Rockridge deployment showed that the majority of users were still willing to use the reservation service even with an associated charge, signaling that many users preferred to make a reservation (pay with money) instead of arrive at the station at an earlier time (pay with time). Some users may also be willing to pay a premium to receive attribute-level data regarding security (e.g., Is it in a safe neighborhood? Is there adequate lighting? Is it gated? Are there security guards?) and convenience (e.g., Does it accept credit cards? Is it close to my destination?). Following its pilot implementation, XM Radio was unable to convince customers or car companies that parking information was a realistic value-added service as part of a navigation system, but future integration with automobile manufacturers, similar to the real-time traffic information, could prove it as a usable business model.

2.5 Procurement Challenges

2.5.1 Agency Contracting Processes

With the growth in private-sector provision of traffic data from non-traditional sources, DOTs wishing to purchase this data must enter into contracts that differ from what their contracts personnel are typically familiar with. A subscription for an XML stream over HTTP does not have tangible deliverables that can be verified for milestone payment. DOT contracts personnel need to be educated on these types of procurements so they have an understanding of and comfort level with the terms and conditions. When a DOT enters into a contract for traffic data, the contract must include standards of performance for that data. At a minimum, it must specify minimum acceptable levels of accuracy and availability.

The I-95 Corridor Coalition, which purchased data for over 1,300 miles of freeway, is using Bluetooth tracking and floating car runs to validate its data every month. Each month, the validation focuses on a different state, so that each state is validated every few months. Michigan DOT, which has just entered into a contract with a different private-sector provider for a similar data stream, will use similar techniques. For each of these procurements, the contracts have mechanisms to penalize the data provider for data that does not meet standards. Whether the penalties are set appropriately remains to be seen. With data on hundreds or thousands of segments every 5 minutes every day, it is likely that standards will not be met for some locations and times. Further, it is only practical to validate a sample of the data each month, and those sampling techniques can make a difference. Penalties need to be set on a graduated scale that takes into account systematic versus episodic errors and the severity of those errors.

2.5.2 Data Compatibility

Both public- and private-sector entities providing real-time freight information may lack the ability to standardize information to share with other entities. The federal government has the opportunity to encourage, although not mandate, the creation of standardized information exchanges, including working with vendors and the trucking industry to develop more accepted data standards. In the creation of data-sharing standards, it is imperative that there be a strong focus on creating incentives to encourage the commercial vehicle industry to participate.

A clearer definition of what information should or must be collected and disseminated by the public sector versus what should be the responsibility of the private sector is still yet to be determined. Leveraging information from both public and private sources, the private sector has clearly established and developed its own need and use for in-cab telematics, but improving freight travel and goods movement is in the best interest of the public. Intermodal facility and border-crossing freight information systems, such as the Cross Town Improvement Project (C-TIP), have required the public sector to encourage development by establishing partnerships and providing funding and leadership. While the public sector does not expect these systems to continue as a government service, additional research must be conducted to develop effective business models for providing information to commercial vehicles for a cost-effective service fee.

As the successful collaborations have already been developed with telematics vendors, the public sector can develop further partnerships with the commercial motor vehicle industry and device vendors to steer requirements and standards and share information.

2.5.3 Privacy and Data Protectionism

Information related to the locations and operating characteristics of commercial vehicles provides for improved real-time information. However, many carriers have concerns about making such information available for several reasons, including:

-

Enforcement – Carriers are concerned that federal, state, or local agencies could use collected information for enforcement purposes.

-

Plaintiff lawsuits – Carriers are concerned that plaintiff lawyers could use information to build cases, particularly in jurisdictions that stipulate that if a driver is 1-percent responsible for a crash, he can be held 100-percent liable.

-

Competition – Carriers are concerned that competitors could gain proprietary information related to operating characteristics, common routes, or lists of customers.

This is also true in the traffic realm. Many of the probe-based deployments that are able to provide speed estimations have established partnerships with fleet operations (which could include a wide range of fleets, such as commercial freight, rental cars, and others). These arrangements are proprietary, with no disclosure as to density or specific vehicles that might be providing data.

While the commercial vehicle industry may be reluctant to share proprietary information directly with the public sector, third parties may serve as a useful liaison. The public sector currently partners with the American Transportation Research Institute (ATRI) and the trucking industry through the Freight Performance Measures Initiative to aggregate and scrub freight probe data to establish a baseline for freight mobility and the transportation network. Many trucking companies also use Qualcomm and Maptuit, private companies that provide in-cab routing services based on current vehicle location, leveraging traffic and weather information from other in-network vehicles (these may be some of the same partnerships that contribute to traffic probe data). Since it is unlikely that the public sector will have access to unrestricted, uncleansed data, it must work with carriers to develop additional mechanisms for data sharing, while ensuring that proprietary information remains secure by establishing additional partnerships and non-disclosure agreements to provide a means for public and private partners to access relevant freight information that has been scrubbed of proprietary information. As part of any partnerships that are developed, a clear understanding must be communicated regarding what proprietary information will or will not be shared and with whom.

2.5.4 Sharing Data Among Partners Across Geographic Regions

The inability to share data is a barrier in developing real-time traveler information systems, although there continues to be strong interest in exploring partnerships for data collection, aggregation, and dissemination, including public-public, public-private, and private-private partnerships. Merging multiple data sources can be resource-intensive from an institutional as well as technology standpoint.

From a public-sector perspective, agency integration efforts to harness incident data from law enforcement/public safety through automated information exchanges are resulting in significantly expanded capabilities for providing incident information. For non-urban corridors, this might be the only available real-time data about corridor travel conditions. Two benchmark deployments for CAD and traffic management center (TMC) integration were conducted by Washington State Department of Transportation (WSDOT) and Utah DOT. Key lessons from these deployments indicated that it is largely up to the public sector traffic/DOT to initiate and spearhead this kind of collaboration and data-sharing arrangement, including bearing any cost requirements for integrating systems or modifications to the public-safety CAD system. Establishing these partnerships to share automated incident data feeds requires collaboration among state DOTs and state and local police and law enforcement, as well as CAD system vendors.

Many metropolitan areas, especially large metropolitan areas, have several transit agencies located in close vicinity to each other, with overlapping and concurrent transit services. This requires a substantial amount of coordination among the agencies to develop a seamless information network across the multiple transit agencies. Data and information sharing between transit agencies is primarily related to the trip-planning function and is based on scheduled, not real-time, information.

While transit agencies are the primary actors with respect to implementing real-time transit information partnerships, outside companies with particular technical expertise are beginning to show interest (including Google Transit and some cell phone companies). Some transit agencies prefer to allow third-party access to open-source data, providing them with the opportunity to develop additional traveler information applications. Open-source data allows companies such as Google Transit more freedom to create user-friendly transit applications and may also provide for additional and more sustainable business models. Issues such as data security and knowledge of data usage are two key challenges that must be overcome. Transit agencies must develop an improved understanding of their responsibility toward their data and when the benefits of sharing data outweigh the risks.

Parking is another area where there has been increased emphasis on establishing more regional networks that include information from a variety of information sources, both public and private. Presently, many deployments use proprietary data and patented systems and business models. To develop the industry, parking operators must be educated on the benefits of information sharing and how information can be safeguarded to ensure that it does not directly benefit their competitors. Additional communication between the private and public sectors will ensure that collaborative solutions can be developed and issues can be resolved quickly, including ensuring that data is available and information is provided when necessary.

A common theme among all real-time freight information systems, both public and private, is that each requires substantial buy-in from a variety of stakeholders, often public agencies and always private companies. Providing freight information to commercial vehicles can only be effective when trucking companies are willing to participate in the process, including sharing information regarding their real-time information needs. For example, WSDOT has actively engaged the trucking industry in developing its Freight Notification System including industry debriefs, online surveys, and complaint monitoring to assist the agency in understanding the types and frequency of information required by trucking companies.

2.5.5 Industry Fragmentation

While some commercial vehicle industry groups have had some success pooling resources to benefit the industry, trucking remains fragmented with the majority of trucking companies only owning a few vehicles. This fragmentation increases the difficulty to develop collaboration within the industry to build data models and provide real-time information. In the limited number of deployments involving collaboration between the public and private sectors, trucking companies have been very cooperative in helping to develop real-time systems. However, additional interaction is needed, particularly among competitors.

Fragmentation is also apparent in the public sector, with little inter-agency collaboration between state DOTs, metropolitan planning organizations (MPOs), port authorities, and border agents working to build real-time freight information systems. In fact, only a handful of systems that provide freight-specific information in real time exist across the country. One of the newest systems, C-TIP, may serve as a useful model for deployment to other high-freight areas. The public sector must establish improved partnerships among its agencies and with the private sector to identify freight bottlenecks that would benefit from real-time information. Some 511 systems are also beginning to add information that is more beneficial to freight, although the nature of 511 being operated by individual states does not lend itself well to multi-state corridor conditions via the phone (through public-agency-operated systems). The Web provides an easier platform for this kind of information, but may not be as accessible to freight drivers en route.

2.6 Potential Roles for the US DOT

Regarding procurement and partnerships, the US DOT could take a leadership role in the following key areas to provide valuable guidance to states and operating entities.

Agencies are interested in support from the US DOT to better ensure traffic data quality. Processes to validate purchased data have been enacted by a few DOTs with private-sector data contracts, but there is no consensus on the appropriate validation methods or how the data provider should be penalized for failing to meet data quality standards. Roles for the US DOT could include white papers, proof of concepts, research, or analysis of existing systems, and continuing to sponsor outreach and forums to allow for peer exchanges of lessons learned (similar to the Probe Data Quality Workshops currently underway).

Quality standards can be developed on the national level to ensure that the amount of data collection devices or probe vehicles would satisfy a basic level of quality for the dissemination of that data to the public. The 1201 Rulemaking begins to define this for traffic, but does not provide the detailed quality parameters that would be necessary for contracting purposes. This will give local and state agencies clear and consistent guidance and direction as to what they could or should do to get better data for their systems. Linking the quality of data with the revenue provided to collect that data would help to increase the standard for quality.

There was particular interest mentioned for the US DOT/FHWA to explore negotiation with the private sector on a national level that would provide data on a local or state level. This could provide not only a standardized method for distributing the data to public agencies, but it would also support the reliability of that data due to the larger scale application.

The US DOT needs to encourage states to increase situational awareness of traffic and weather conditions and develop multi-state networks of information, including providing incentives for state DOTs. Funding could also be dedicated to collaborative groups like the I-95 Corridor Coalition, which could continue to foster innovative demonstration projects for both traffic and freight, particularly in a multi-state context.